Raise your hand if your living the Great Australian Dream?

In past decades the Great Australian Dream became reality for many who rode the debt wave of the 1970s, 80s and 90s. The dream was an expression of financial security as nothing was "as safe as houses". Fast forward to today and Generations X, Y, and Z have little more than a pipe-dream of affordable living and affordable mortgages. We have to try to keep up with the Jones (Baby Boomers), or complain from outside (like i'm doing here). For now, some younger Australians may do well in the short term by embracing government first-home owner handouts, multi-decade low interest rates and other incentives to try to live the dream... and for now Australia is apparently defying gravity. I believe the dream will cause long term indigestion for some, for decades to come if people do not have a backup plan once asset deflation hits Australia on mass. Liquidity on hand will be king (gold/silver not Australian Dollars).

2009 – house prices hesitate and take off again.

Australian house prices ended up rising 1http://scottreeve.blogspot.com/2009/02/beware-australian-housing-debt-bubble.html, the fourth highest growth rate in the world behind Hong Kong, Mainland China, and Israel. However, globally house price deflation continues with house prices falling by 3.8 per cent, led by Ireland, Dubai and Eastern Europe. In my post last month, there is an excellent graph highlighting the next wave of delinquent mortgages on the way (1 in 7 trouble). China will follow, and i'll post more extensively on its problems.

Chart 1:

source: Australian Financial Review, March 2010

source: Australian Financial Review, March 2010Chart 2: Australian house prices by city

source: ABS

source: ABSChart 3: The dip and the rebound...

source: ABS

source: ABSThe great Australian ponzi scheme continues upwards again. The combination between unprecedented population growth, low housing starts, government handouts, very low (central-bank manipulated) interest rates, and double-digit M3 inflation growth in the system (during the GFC period) ensured that there would be enough fuel to get more buyers into the Australian housing market. Externally, more and more money is coming from businessmen in China, India and elsewhere whom currently see Australia as a place to invest their savings for a return.

Lets examine each of these issues more closely.

A) unprecedented population growth

Chart 4: 300,000 to 400,000 net new people each year now... lets make the aging population problem (and hospitals) worse.

source: ABC News

source: ABC NewsChart 5: Govt: "Even if there wasn't a "real" shortage... lets create one"...

source: ABC News

source: ABC NewsThat's a lot more people that need to consume and a roof over their head. A lot more people that might be bringing valuable skills to Australia right now (a quick fix? ...), but eventually will also add to the hospital cues (and potentially unemployment ques when the economy goes pear shaped). The aging population is still aging!

B) Housing Starts manipulation

As the following graph demonstrates, the three levels of government have successfully been manipulating the supply-side of the housing market, by staging land releases. Arguably, the three levels of government in Australia are the most addicted to keeping Australian housing prices upright, and the most to loose when asset-deflation sets in. Primarily, strong price growth in housing equates to overall consumer confidence in the market, and ultimately confidence in government economic management. Further, local governments remain fixated on housing rates to raise revenue to spend on local roads, while revenue-deprived state governments grow increasingly reliant on land and stamp duty taxes. A blow in confidence in the housing market is a blow to government revenues (direct taxation), but ultimately a total decline in confidence will flow through to less employment (income tax), business profitability etc.

Chart 6: It's in Government interest to not flood the market with too much land...

source: ABC News (RBS data)

source: ABC News (RBS data)C) Government handouts – 1st homer owner loans

In the first stimulus package (A$10.4bn) announced in October 2008, the Rudd Government introduced a First Home Owners Boost to go onto of the First Home Owners Grant. With interest rates cut to four decade lows, this just added further candy to the honey pot to entice young Australians into the housing market. I'm a graph person, and I found the following interesting to decipher. Government's throwing money at problems just disrupts market behaviour. When the Government intervention is removed, the market goes back to levels before their intervened.

Chart 7:

source: Australian Financial Review (analysis added)

source: Australian Financial Review (analysis added)D) Very low interest rates

Unfortunately, the four decade low interest rates set by the Reserve Bank of Australia has encouraged more and more Australian to take on ever larger mortgages. Lowering interest rates has had a very significant influence on keeping Australia’s housing prices upright during the GFC and post-GFC period. If the RBA did not intervene in the market to lower interest rates (essentially adding more liquidity, more Dollars to the market), than many Australian’s would not have entered the housing market, or bought addition properties. The RBA is nothing more than a market manipulator, to manipulate investors decisions and to disrupt real market information.

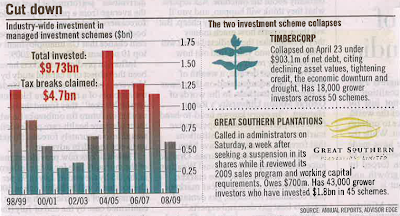

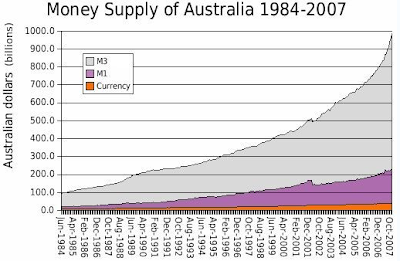

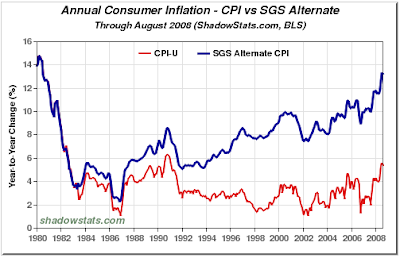

E) Double-digit M3 inflation growth

In one of my first posts in September 2008, I talked about money supply growth and that it was growing at the fastest annual rate since the 1970s. This was in part due to the housing bubble that has continued. But the dip in housing between March 2008 and March 2009, the drop in confidence during the GFC period, the rise in unemployable and underemployment,, and the reduction in bank lending in Australia cooled M3 growth. Right now the annualised rate is back to 5.7 per cent. So the volatility continues. I expect M3 to grow strongly once again (similar to 1970s), and ultimately will go crazy as Government's get desperate to bail out certain industries... Inflation always has a 12-18 month time lag... so even though it may be growing more slowly now, the overall costs of living continue to rise. I don't see milk or rents going down..

Other interesting tid bits:

Steve Keen walks to Kosciuszko from Canberra

Where to from here?

May 2010, the sharemarket is looking shaky with the Dow Jones breaking back below 10,000 point level. Housing market quarterly growth continues in Australia for now... But I ask, what has structurally changed from 2-3 years ago? Structurally nothing has changed in the world since before, during and after the GFC. The United States only continues to live beyond its means because it has the world reserve currency, and can print its way out of trouble for now. Europe, Japan and others have held up until now because confidence in private and government debt has been suffice to keep the current ponzi-fiat-monetary system going. People are waking up to this, and volumes of gold, silver and other so-called "relics" sales are going through the roof (mint-door sales). Real estate markets worldwide continue to fall in local-currency prices - Hong Kong, Mainland China, Israel and Australia are still the exception... for now. Deleverage of over-inflated asset prices will continue (derivatives....), and many more AIG, Lehman's are around the corner - this time Government names will be added to the list (just not officially). Australia looks good for now, but this can quickly change over night. Putting all our eggs in the one basket - superannuation, real estate and relying on exporting commodities to China will inevitably cause major problems for us (Australia). China's centrally planned economy will blow up, they cannot spend, spend, spend, just like the US tried to do with retail consumption and sub-prime. Populating, (retail) consumption and inflating our way through the GFC appears on face-value to work, but it is only postponing our problems: Aging population, consuming the future today (we have no private savings), and increasing our costs of living by diluting our money supply. Now is the time to find value in markets....... I don't think the next 20 yrs will be like the last 20 yrs. Printing money can only cover up so much for so long...

The great Australian dream will turn out to be nothing more than the Great Australian Ponzi Scheme.

Scott