The MIS industry prospered over the last decade purely as more investment flows came into the companies each year by paying high short-term returns at the expense of long-term balance sheet sustainability (from future profits).

In many ways, the MIS industry is akin to the Babcock and Brown or Allco Finance model. Take low yielding assets that have a long investment time frame, sell the assets to investors on the sharemarket, inflate the yield numbers over the short term, and skim large amounts of fees off the top. This model worked brilliantly when the economy (and the money supply/credit/debt) grew consistently and individuals looked for investments to expand their wealth. Now the debt model is broken and the MIS industry has been exposed as a complete fraud.

However, the real fuel on the fire was the lure of a tax break. The tax rules on MIS schemes in the 1990s early 2000s made it ideal for investors who wanted both an investment and a way to minimize tax. In a way it was a voluntary savings scheme (similar to Superannuation), the scheme mangers were almost guaranteed to get a growing number of buyers for their schemes each year.

Like all ponzi schemes, the system starts to show huge cracks when the liquidity of buyers starts drying up.

The first major crack was an ATO crackdown in February 2007, which prevented non-forestry MIS (such as almonds, olives) from receiving upfront tax deductions. The increased uncertainty created from this no doubt have a significant impact on the financial sustainability of the MIS industry.

The second crack was under delivering investors. When the first timber projects were harvested, yields were well down on what investors were told a decade earlier. The assets (the trees) were considerably less valuable.

Third, both Great Southern and Timbercorp took on substantial debts to keep the schemes going. Taking on large debts (with less investor equity) in the boom times worked (ala B&B model). As we know with the Global Financial Crisis (GFC), debt-based models are no longer sustainable and companies are now rushing to raise equity at any cost. The MIS could no longer raise any credible equity or debt and the great ponzi scheme has been felled.

It turns out Timbercorp and Great Southern became the biggest of the MIS schemes because they were the best at selling schemes (with the tax break lure). As it turns out, they weren’t in the business of making fat profits via harvesting – ie. what investors were led to believe.

As an example of the largess of the industry, Great Southern spent $62.3 million on commissions, marketing and promotion of its products in the year to September 2008.

However, despite the commissions, fees, tax breaks and other incentives, lets not forget that the agriculture and forestry industry, like any investment, has risk.

The risk/reward relationship changed for the MIS industry substantially over the last 10 years. Risks were overlooked in the earlier years because of the lure of the tax break. Without the tax break, it is now known that TIM and GTP were high risk/low (no) reward investments.

Further, Agriculture and forestry is susceptible to serve weather conditions, particularly drought. This has no doubt impacted on expected yields and expected future profits. The 62,000 investors caught left holding worthless paper when the music stopped, like any investor, have to take personal responsibility for their investments. The financial/investment industry has its fair share of bad advisors who give bad advice on bad investments. Economists also don't have a crystal ball about he future on tax changes, climate influences etc. Investing is also about timing and discipline. Every investor must have an exit strategy for when things start to go wrong. As we now know the investment world no longer tolerates high debt companies. For instance, Timbercorp had debt gearing of 62.4 per cent in 2007. The charts of both Great Southern and Timbercorp show investors have been deserting the companies for the last 3 to 4 years.

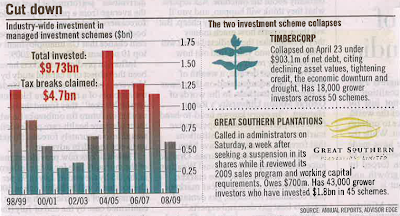

All up over $10 billion in investment flows went into the MIS industry over the last decade, with and estimated $4.7 billion in tax breaks received.

As the following graphic details, Timbercorp fell with over $900 million in debts, while Great Southern owes around $700 million.

Chart 1: Total invested in MIS in last decade

source: Financial Review, 19/05/2009, page 61

source: Financial Review, 19/05/2009, page 61Chart 2: Timbercorp’s investments

source: Timbercorp website

source: Timbercorp websiteChart 3: Great Southern’s investments

source: Great Southern website

source: Great Southern websiteDeflation to hit rural property prices

I’ve discussed a number of times that I believe there were continue to be deleveraging of debt across Australia and the world. All types of property in Australia are at high, immediate asset-deflation risk (commercial, industrial, residential and rural properties).

The collapse of the two largest MIS schemes should have a significant impact on rural land prices across Australia. During the last decade, MIS has been criticised by many rural communities for pushing up land prices (due to their investor and bank backed purchasing power) and accelerating the decline of many rural communities. Traditional farmers could not compete on land purchases, and many of the best grazing properties were turned into hardwood plantations.

Now with the collapse of Great Southern and Timbercorp there is talk of an immanent fire sale. Great Southern has 240,000 hectares, while Timbercorp has 120,000 hectares of property. Just like a bank taking back a default home mortgage, they will not be interested in holding onto all this surplus property. It will be dumped onto the market for whatever price they can get. We now have a reverse outcome to the last decade. The buying force of a the MIS industry pushed prices up dramatically, are now crossing over to the seller side. When administrators/banks are the sellers, lookout below… Severe asset-deflation is coming. The only hope is if a major foreign investor showed up to buy most of the assets.

Debt will continue to be the downfall for many individuals, businesses, and even Governments. Timing and discipline is key. We are no longer in a debt cycle.

- Scott

2 comments:

Nice write up Scott

However i would like to point out some (real world)things that don't quite tally with the news package that the media has delivered for our consumption...these schemes failed because the expectations were always to high and not realistic, harvesting trees after 10 or 12 years is ridiculous, even for pulp.

The drought had little to do with the low yields...management is critical in the first 4 to 6 years of plantation establishment,and that "hands on" management costs money, money that the management were not willing to spend as there's no pay off for them, easier to just sell more plots.

Also anyone with any forestry experience could see that the numbers in the prospectus just didn't add up...it was obvious to me anyway that they were charging

10K for about 3K's worth of trees.

360 thousand hectares is nothing in forestry terms, there will be little quality farmland price deflation as a result of these MIS failures...as very little, quality land was used for these plantations.

Hi So_Cynical

Thanks for coming over from the shares forum. I appreciate your input.

On reflection, my arguments for price deflation of rural land was probably too strong in this instance. There are particular rural areas which are heavily involved with MIS who will likely be impacted (without well leveraged buyers coming to the table), but the majority of rural Australia exist without substantial MIS business (or GTP, TIM schemes). Many of these rural centres survived o.k. long before MIS existed. There is also a lot of card shuffling in the rural scene in recent months (property changing hands), particularly in beef.

As an investor I never touched MIS, nor fully understood the yield promises conveyed from TIM, GTP. In their aftermath though I’m particularly interested in the Debt aspect of TIM and GTP. No doubt they used their leverage (buying power) to push up land values each year (through debt and equity). Now they are both down and out, there will be significant economic impacts on local communities connected to their schemes (employment, land values).

I strongly believe the macro economy will be the overarching influence on properties across Australia (including rural land). Debt was king in the 1980s and 1990s – but debt now toxic (unless Govt’s, central bankers can inflate their way out of the problems in a big way). The macro economy will have a much greater impact on rural communities than the collapse of TIM and GTP, no question. The easy money is gone. Fewer individuals, businesses, farmers have the financial capacity to take on more debt to keep the system moving forward.

Interesting times.

Thanks again for visiting the blog.

Scott

Post a Comment