Saturday, September 27, 2008

Not the time to be an arm chair analyst

This week it was Washington Mutual (WaMu) - the biggest savings bank to go under in US history, but perhaps not officially... JPMorgan came to the rescue! and will pay US$1.9 billion for the troubled bank. If Washington Mutual was not taken over by JP, there would have been a massive bank run on its deposits, and likely the start of substantial withdrawals from other US banks. A bank run happened earlier in this year when IndyMac Bank (California based) went under, at the time it was the 2nd largest bank failure in US history. (There are new records created every week at the moment!) WaMu with assets of $US307 billion, easily beats IndyMac ($US32 billion), and Continental Illinois National Bank ($40 billion) which went bankrupt in 1984.

With JP stepping in, the US Federal Deposit Insurance Corp (FDIC), which insures US bank deposits, was let off the hook (not a coincidence I believe). Without JP at the scene, FDIC would have been forced to cover the savings held by Washington Mutual.

Who is FDIC?

As the FDIC website states:

- (FDIC provides a) basic insurance amount is $100,000 per depositor per insured bank.

- If you and your family have $100,000 or less in all of your deposit accounts at the same insured bank, you do not need to worry about your insurance coverage -- your deposits are fully insured.

- FDIC insurance is backed by the full faith and credit of the United States government.

The irony is that FDIC was created in the midst of the last Great Depression in 1933, because of a huge amount of bank failures and loss of confidence in banks. Today, many Americans would have confidence in this corporation (if they were aware of it) to back their savings if there was a bank run. The bottom line is - this corporation is all "smoke and mirrors", and it will not be able to cover a massive bank run when the next one happens. If it did honour deposits in a large run on the banks, the US would have to print trillions of dollars to meet its obligations. The ultimate end result is hyperinflation.

In the last Great Depression more than 1 in every 5 banks failed. Between 1929 and the end of 1932, nearly 5,100 banks had failed in the United States. Money supply shrank by one third, as people were not prepared to take out new loans (liquidity problem - sound familiar?). There was no confidence in the banking system. FDIC was created to help restore confidence in the banking system, by backing deposits with the "Faith" of Government (but it didn't work...). As I have raised previously, the US Government will only be able to print money to meet future promises, liabilities, and obligations.

Arm Chair Analyst

Everyone has an opinion. Right now more people are interested in talking about whether it will be Obama or McCain as the next US President. The bottom line is - it doesn't matter anymore. Whoever gets in will only have one economic card up their sleeve, and that is to keep printing money, devalue the $US Dollar (relative to other currencies and gold/silver), and erode the purchasing power of the US economy through a double digit inflation tax. There are differences between candidates, but economics is the primary element to capitalism. People need secure assets, secure jobs and a secure monetary system. Without this, social, environmental, military progress etc is not sustainable.

Now is not the time to be an arm chair analyst.

There will be many people that will say in a few years time:

- "I knew the $US Dollar would collapse"

- "I knew gold and silver prices would go crazy"

Words are worthless if you do not back them with actions. Forget the tabloid-trivial politics. Do not rely on populism or mass-media propaganda. They will always distort the facts. Whether its climate change (how many jorno's have a degree in schience and climatology?) or the nightly finance report (who cares if Telstra goes up or down 1 cent?). You must do you own research and due dilliegance, and question everything the pollies or the mass media tells us.

Three Teirs to Action:

1) Education - Spend X hours a week studying the events happening in the US. What does WaMu. Lehman Bro's, $700 bn rescue package mean today, but more importantly what will this mean for tomorrow?

2) Have a plan that recognises the period ahead. How will your preserve and duplicate your wealth? How will your combat eroding purchasing power to double-digit inflation?

3) Accumulate holdings in precious metals.

Change your context

When you realise the seriousness of what is about to hit the world economy, a light bulb will go off in your head. You will be consumed to learn as much as you can about the current events and what you must do to preserve and transfer your wealth.

So far I have detailed many facts and figures, but this will mean nothing unless you change your context. We have to stop measuring things in terms of paper money (US$, A$, Yen etc), and instead measure things in terms of purchasing power.

Already we are around 8 years into a great precious metal bull market, but very few people are aware of it. Gold and silver will offer the greatest purchasing power, and wealth transfer for the decades ahead. Those holding gold and silver will do very well, provided they have a plan and do not flip and sell for currency "profits" along the way.

There is a lot to take in - but the more knowledge you have, the better equipped you will be to take action early - but only if your context has changed and your inner instinct forces your to take action...

To finish today, I suggest wetting your appetite with some of the video clips below.

Cheers,

Scott

Monday, September 22, 2008

What is $700 billion worth?

$700 billion works out at:

* US$2,000 for every person in the US

* More than the GDPs of Argentina and Chile combined

* 70 percent of Canada's GDP

* The annual Pentagon budget, including the wars in Iraq and Afghanistan

* 20 percent of what the US spent in WWII

* Twice what the US spent in WWI

* More than twice what the US spent on the Korean WAr

* 100 times what the US spent in the Spanish-American War of 1898

* 100 times the annual cost of the US Heat Start program, which helps 900,000 children from poor families

* 40 times the NASA budget

Here are some of my analysis:

- To put it into Australia's context - the US$700 billion is 77% of Australia's GDP!

- The amount is also akin to a mini- US budget, roughly about 1/4 of the expenditure of a usual US budget today.

$700 Billion in context of existing US Government Debts

- In 2008, the US Government spent $431 billion in interest repayments on the existing debt, which currently totals over US$9.7 trillion. Obviously current debt is already unstainable and past the point of no return. The US Government collects about $2.66 trillion in taxes (2008), so interest on debt is one of the largest expenditures on its books, representing about 16% of total revenues!

ASX opens at 11am?

On a somewhat different note, the ASX didn't open until 11am today. I thought Comsec had spat the dummy again. The Australian Securities and Investment Commission (ASIC) decided at the last minute to ban all types of short-selling in Australia (naked and covered), in response to moves by the US and UK last week. Freezing short selling always tends to happens in times of economic uncertainty. I believe there are pros and cons for short selling (naked shorts are the dangerous ones). ASIC really should have got things sorted before today. The confusion in the market was just not needed, especially with whats been happening in recent weeks. When the market did open, most stocks has huge gaps, such as MQG (up 17% on open) and FMG (up 31% on open!). Most then drifted lower during the day. Nothing like seeing short sellers buy up (to close positions) in a market frenzy...

Cheers,

Scott

Sunday, September 21, 2008

The most economic volatile week in history?

Following from my last post on Monday, we have witnessed even more extraordinary events this week.

- After Lehman Brothers filed for bankruptcy (the biggest in US History), AIG, the world's largest insurer was bailed out of potential bankruptcy by the US Government.

- British bank Lloyds TSB agreed to buy rival HBOS to create a 28 billion pound ($63.9 billion) mortgage company. HBOS was

Britain's largest home loan lender

- Current speculation is that Morgan Stanley and Wachovia are in talks to merge, and that Washington Mutual, the USs' largest savings bank is in trouble.

- Gold had its largest one day (*market*) spike in history, up a lazy 8.9%.

- Over the weekend, the United States Treasury unveiled a $US700 billion ($A871 billion) rescue plan for the troubled US financial sector. With the stroke of a pen, this would be equivalant to the US increasing its money supply by about 7 to 8 percent! (assuming M3 money supply is currently about US$14 trillion).

The US GOvernment will aquire up to US$700 billion in home and commercial mortgages from US-based banks over the next 2 years. To do this, the U.S. government's debt limit would rise to $11.315 trillion from $10.615 trillion.

Short Selling

On Friday both the the U.K. Financial Services Authority and the US Securities and Exchange Commision (SEC) took action to prohibit some short selling practices and to require much greater disclosure of short-shorting selling positions. This had huge implications for the world markets on Friday.

On Friday:

* The FTSE was up 8.8% for the day.

* The Dow Jones was up 3.4% for the day.

The main reason why the FTSE and Dow went so strong is because short sellers were closing a lot of their positions! To close their position they must buy. (its opposite to going long. They sell high first then buy low to close position, as opposed to buy low, sell high).

United Kingdom:

On Thursday the UK Financial Services Authority halted all short-selling of financial companies, which would be in effect until 16 January 2009 (but may go longer).

United States:

On Friday the SEC announced, effective immediately, that 799 financial companies would be protected from short-selling practices until 2 October 2008. There is talk congress may even put a bill together to constrain short-selling altogether.

Australia:

The Australian Securities Exchange (ASX) on Friday said that it would prohibit naked short-selling from tomorrow on all securities, while covered short selling will require greater disclosure.

This, along with the surge in world stockmarkets on Friday, will likely lead to big gains on the ASX tomorrow. Banks and financial stocks in particular should do very well, along with any stock which has been short-sold heavily in recent months such as Fortescue Metals. (ie. stocks which have large amounts of debt!)

Investment Bank Model Dead?

For now it appears the only large investment bank left in the US is Goldman Sachs. Bear Stearns and Lehmans are gone. Merrill Lynch has merged, and Morgan Stanley is believed to be on the cusp of merging. This is a huge turn around inside 12 months! The following graphics show how the US financial scene has changed so quickly for 29 (now 26) of the biggest financial firms.

Source: http://www.nytimes.com/interactive/2008/09/15/business/20080916-treemap-graphic.html

Chart 1: Market cap of 29 selected financial stocks as at 9 October 2007

Chart 2: Market cap of 27* selected financial stocks as at 12 September 2008

Result: These 29 companies have lost almost US$1 Trillion in market capitalisation, with the total financial sector loosing about US$4 trillion in market capitalisation so far.

Result: These 29 companies have lost almost US$1 Trillion in market capitalisation, with the total financial sector loosing about US$4 trillion in market capitalisation so far.Macquarie & Babcock to follow?

All through this weeks turmoil Australia has largely been untouched (so far). However, concerns of Australia's two investment banks made Macquarie Bank (MQG) plummet 23 percent on Thursday, before rebounding 37 percent on Friday. Babcock and Brown (BNB) hit a low of 68 cents on Thursday. BNB was over $30 dollars per share in November 2007. It has now fallen 97% in only 10 months!

In my opinion Babcock and Macquarie will not survive - its a matter of timing. Macquarie today is in a lot better shape than Babcock of course but it too will not be able to weather the global economic crisis which will progressively get worse in the next few years.

The investment bank model is built on debt and expectations. Assets are geared with a lot of debt on the basis that the assets will continue to appreciate in time and that revenue streams would appreciate in time. Some of the world's largest investment banks have gone under because the cost of debt (and the loss of liquidity) has gotten out of hand. Macquarie and Babcock own long-life assets which used to be owned (or provided) by governments. Airports, ports, roads, power stations etc. Expensive assets which have large sunk costs and require substantial maintenance.

For example, the toll-road model is flawed, and there are a number of toll road floats on the ASX in the last couple of years. They are built on over inflated expectations of usage. These expectations are used to finance the equity and (mostly) debt to get the roads built. Governments know exactly how expensive roads are to build and maintain, investment banks are only now waking up to economics101. Economies have booms and busts, but the investment bankers believe we will always have booms.. The big global boom is over, and now we are heading for one of the biggest busts in world history. Its all a matter of timing.

Right now though, We are currently experiencing first hand the worlds worst financial crisis since the last Great Depression. The populus (in the US, Australian and the rest of the world) still has a tremendus amount of confidence in Government and their ability to print their way out of financial demise. This won't and can't last forever. The more money they throw, the longer they put-off the inevitable collapse, and the more money there is to fuel inflation. I predict hyperinflation will eventually come into play and this will be the catalst to bring about a loss in confidence in Government (whom backs our currency, our money supply).

Until next time,

Scott

Monday, September 15, 2008

The Derivatives Bubble - signs of the iceburg underneath?

Today we have seen the fourth largest investment bank in the world, Lehman Brothers files for bankruptcy. This follows Bear Stearns (who got bought for $2 p/share by JPMorgan) in March this year.

Bank of America pays US$50 billion (A$60 bn) for Merrill Lynch.

Also today, 10 Global banks had "pledged" to throw $US70 billion to help the credit squeeze. Drop in the ocean! I thought they would be more desprite then that...

What is a derivative?

Derivative are essentially bets. They are usually in the form of futures, forwards, options, and swaps. They are used to hedge risk, to speculate future events, and to provide (often significant) leverage to the investor.

There are scores and scores of different derivative products.

Impact of derivative so far:

The sub-prime mess was born through property derivatives. Bundled up mortgages, securitized and sold to foreign investors on the assumption property prices would continue to increase over time.

The US is now witnessing the first of the derivatives bubbles. The Property market bubble. In only 5 years US residential property debt grew from US$4 trillion to US$12 trillion. As discussed previously, Fannie Mae and Freddie Mac have now been bailed out by the US Government to try and hold the mortgage system together.

Derivatives compared to world GDP:

In 2007:

* World GDP is around US$53 trillion.

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)

* Total derivatives market is believed to hit a record in 2008 at over US$750 trillion!

Derivatives have exploded in recent years to be 15 times the size of the world economy. So for every $US dollar being created through goods and services, there are $15 dollars being gambled in the derivatives market!

The Big Three that will ultimately bring the down the world economy?

Remember these 3 banks.

As of March 2008:

* JP Morgan - US$90 Trillion in derivatives

* Bank of America - US$38 Trillion in derivatives

* Citigroup - US$38 Trillion in derivatives

These three banks alone are betting 3 to 4 times world GDP.

The top 25 US banks derivatives exposure is detailed in the table below.

Table 1: source: http://www.occ.treas.gov/ftp/release/2008-74a.pdf (p. 25)

As of 14 September 2008, JP Morgan had a stockmarket capitalisation of US$141 billion, yet according to the US Treasury, the company has potentially $480 billion dollars at stake from derivatives trading alone!

What about Derivatives exposure in the rest of the world?

The rest of the world is knee high in derivatives.

For an overview of the world situation (by currency, instrument etc) see the Bank of International Settlements website.

http://www.bis.org/statistics/derstats.htm

For further study on the Derivatives Bubble ahead I recommend seeing these two video clips as a starting point.

Ponder this last thought:

Two third's of banks in the US filed bankruptcy in the last Great Depression. Lehman Brothers was one of the few that survived this period and went on for 158 years until... today.

Study the past (monetary history) and you will see the future. We live in interesting times.

Cheers,

Scott

Saturday, September 13, 2008

Money Supply, Debt, Inflation and Purchasing Power!

What is Money Supply?

- is the total amount of money available in an economy at a particular point in time.

(http://en.wikipedia.org/wiki/Money_supply#cite_note-18)

Money supply used to be backed by a gold standard. However all this changed in 1971 when the Bretton Woods system fell apart. Today money represents debt. The total supply of money is infinite so long as there is debt in the economy. No debt = no money being created.

Money supply and Inflation

To leverage our potential buying power we borrow money (debt) to be able to buy more goods then what we could have done otherwise. However, the first rule in economics is that we have unlimited wants, yet limited resources. So at its most basic level, the more money supply in existence (created from loans), the more money there is competing for food, land, labour etc. This leads to price inflation and increased volatility and uncertainty in the economy. Booms and busts become more extreme.

How do you measure Money Supply?

In Australia the RBA define Money supply as:

M0: currency

M1: currency + bank current deposits of the private non-bank sector

M3: M1 + all other bank deposits of the private non-bank sector

Broadmoney: M3 + borrowings from the private sector by NBFIs, less the latter's holdings of currency and bank deposits

M3 is generally used by economists to estimate the total amount of money available in the economy.

What increases money supply?

Every time someone borrows money from the bank, the money supply expands. If you get a new mortgage for your house, or a margin loan to buy shares, you are helping increase the money supply and you are leveraging credit. Through fractional reserve banking, banks have the ability to make money out of thin air. If the fractional reserve is 9 to 1, you deposit $1,111.12 dollars into a bank, the end result is that the original $1,111.12 can ultimately create almost $100,000 of new money!

Movie: See Money as Debt to understand how our Monetary System works today (part 1 of 5 below)

Governments can increase money supply by spending more than they tax (one of the big reasons for money supply growth in the US). US money supply has expanded significantly in recent years due to a double whammy of tax cuts and increased expenditure.

Central banks try to manipulate money supply through interest rates. Central banks do this by buying and selling government securities (and other financial instruments). Ultimately, central banks can only do so much to influence money supply. As we saw in the US earlier this year when the Federal Reserve cut interest rates quickly and threw a $168 billion stimulus package, there was short-term elation, but has ultimately did little to prevent the stockmarket and property prices from falling much lower.

Only a very small portion of money supply (M0) is in the form of currency (notes and coins) generated by a central bank to meet physical withdrawals. This is usually less than 5% of the money supply.

What decreases money supply?

When someone pays back their mortgage (or other debts), money supply decreases. Money supply also decreases when someone defaults on their mortgage or closes a margin loan account, or the Government reduces expenditure and runs surplus budgets.

Central banks try to decrease the rate of money supply growth by increasing interest rates and providing disincentives for people to take out mortgages, margin loans etc.

Ultimately today's monetary system needs money supply (and consequently debt) to keep increasing for the economy to function.

Australia's Money Supply

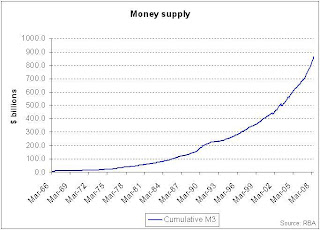

Putting some numbers on money supply growth and using Australia as a case study, we can see that historical through-the-year growth in M3 has been very strong.

Cumulative:

- In the year from July-2007 to endJune 2008 M3 increased 23%

- In the last 5 years (to end of 2007) M3 increased 82%

- In the last 10 years (to end of 2007) M3 increased 174%

- In the last 20 years (to end of 2007) M3 increased 563%

- In the last 30 years (to end of 2007) M3 increased 1847%

As at June 2008, M3 totalled over A$1 trillion Australian Dollars.

Chart 1: Australia's historical through-the-year growth in M3.

Betweem 1971 and 1990, Money Supply growth was very volitile and tended to grow over 10% per annum. The 1990s till 2006 growth was between 5 and 10% per annum. It now appears we are heading for volitile times again.A spike in money supply will trickle into increased inflation.

Chart 2: Cumulative growth in M3 (A$ billions). An exponential curve. As MS increases, debts owed increases.

Chart 3: Log scale of Australia's M3 money growth.

Note the elasticity has been quite constant over time.

The US Money Supply

Since 1944 the US Dollar has been the world currency and until 1971 the $US dollar (and consequently currencies around the world) was linked to gold. Removing the link to gold essentially gave central banks around the world a blank check to print as much money as they want, as the amount of gold under vault no longer constrained how much money supply could exist in the economy. Money is now backed by our confidence in Government (whom guarantee coins and notes are legal tender). The paper used in a $50 dollar note is no more valuable then the paper used in a $100 dollar note – the only difference is that the Government assures us that one is more valuable than the other.

Is US Govt trying to hide something?

In March 2006 (see chart 4), the US Government ceased publishing its M3 money supply data. The reason? To save money!?

Chart 4: United States money supply

M3 was well over US$10 trillion dollars in early 2007.

The simple fact is there is so many $US dollars out there today! (remember a very small amount is actually printed notes and coins ie. M0). As the $US Dollar is the world currency, today about 50% of the world's currencies is in $US Dollars, and about 50% of the $US Dollars reside outside the US! So non-Americans have also contributed significantly to the growth of US money supply.

The US Govt is trying to hide the true rate of inflation. As money supply increases, the new money has to find a home. More money becomes available to compete for finite resources such as food and property. This is why there is always bubbles in property markets, the sharemarket etc. as more money is created through larger mortgages, larger margin loan portfolios etc. All this leads to inflation and ultimately hyperinflation. At the top of booms there is often deflation. This is when buyers hold off from buying in the expectation that prices will be cheaper in the future. Those struggling with their finances are are pushed to sell (to clear debts) are forced to sell to the nearest buyer. People may think their home is currently worth A$1 million dollars today, based on recent prices. However it is only worth $1 million if you have a buyer willing to sign on the dotted line. Your $1 million house might be only worth $800,000 if that’s where the first buyer is. This is deflation.

The $US Dollar = smoke and mirrors

We are constantly reminded by the daily news reports that over the last several years the $US dollar continues to depreciate against other world currencies (namely the Euro). However, in the last few weeks all we have heard is about the rising $US Dollar. I'm expecting this move to be a short-term pull-back, with the long-term downward trend to continue on its way.

As the $US Dollar is the world currency, it has been used as a base reference to provide a measure of value. For example, we hear the price of oil in $US per barrel or copper in $US per pound. Exchange rates are always first compared to the $US Dollar before other currencies. This continues to disguise the true value of assets. The world knows the $US Dollar is becoming more and more worthless over time. Many OPEC member countries are pushing for the $US Dollar to be dropped as the reference currency in favour of the Euro or a basket of currencies. OPEC knows the $US dollar is disguising the true value of their oil!

Is it a coincidence most basic food prices such as rice, wheat and corn have spiked dramatically in the last year? Rice has trebled in the last 12 months, yet the number of people eating rice hasn't gone up dramatically compared to say 24 months ago.

Ponder this. As more people in developing countries go from the poor class to the middle class, deposable incomes increase, and consequently the money supply. There is now more money (supply) chasing a finite resource. Add on top of this, there are hedge funds and large institutions in the futures (derivatives) markets, which help push prices higher (fuelling expectations). This all causes a bubbling of price inflation. As people soon realise they are spending more of their income on food, fuel, rent etc, wage demands increase, which economists argue is the main cause of inflation.

It's all about price expectations! If people expect higher prices, they will factor this into their spending habits. People gradually expect that fuel will cost more. Rice will cost more. Steel will cost more etc. If people expect higher inflation, they will ultimately receive higher inflation (and more money supply).

The US dollar has lost about 97% of its original purchasing power (of 1913) to inflation! The Australian Dollar has lost about the same amount of value, as have most other fiat currencies.

The Euro

A quick word on the Euro.

Chart 5: The Euro M3 money supply is fast approaching the size of US dollrs and is now about 9 trillion Euros.

Conclusions and predictions for the long-term:

- Money Supply growth tells us about the future. The faster it grows, the greater price inflation will be - "the new money has to find a home" - in food prices, in rent prices, in commodity prices etc. There is a time lag for this new money to go through the system and find a home.

Australia:

- Australia's money supply is going to expand rapidly between 10 to 25% plus, and should be volatile like in the 1970s due to uncertainties and expectations in the economy.

The World:

- The $US Dollar will continue to depreciate against most world currencies, however compare any world (fiat) currency to gold/silver/oil and they are all falling.

- The true rate of inflation in the $US is much worse then the US Government is publishing.

- Measuring goods in $US Dollars is disguising the losses in purchasing power.

- The Euro is fast becoming the new world currency; however the Euro’s money supply is increasing at an alarming rate.

In the near future I intend to cover off on some key value indicators. Namely: gold/silver ratio, gold/oil ratio, gold/Dow ratio and go into more detail on purchasing power.

Until then,

Scott

Monday, September 8, 2008

Fannie and Freddie

This year to date (8 September 2008), eleven banks have gone under in the US. Since October 2000, 38 have gone under. (http://www.fdic.gov/bank/individual/failed/banklist.html) Sure, these are mostly small regional banks and have largely gone unnoticed.

The banking system is the lifeblood of the economy. All the banks are interelated. If one goes under it has implications for scores of other banks. The US Goverment has already shown with Bear Stearns that they will do what ever they can to keep the banking system together. (US$ 29 billion thrown at Bear Stearns before JP Morgan kindly bought it for $2 p/share - JP Morgan were in effect doing the US Government a favour). The US Government and top bankers all know that without a secure banking system, you will not have a secure credit and debt market, a secure housing market. Market and consumer confidence is everything in economics. People want trust and security.

Anyway, getting onto Fannie Mae and Freddie Mac. These are key institutions, as they guarantee almost half of the $US 12 trillion US home loans, they are the heart and soul behind the property market. Together they have lost about US$15 billion in the last year. Their shareprices are down about 80% each this year. The US is currently experiencing the fastest growth in mortgage defaults in at least 30 years. So all eyes have been on the Government to save the property market!

Today (8 September 2008) the US Government announced it would take over the pair under "conservatorship" - a fancy word for takeover. The Government now has first dibs at becoming a major shareholder of both companies, with remaining shareholders destined to loose almost (or even) all their money in the coming year(s).

The US cannot afford for Freddie and Fannie to go under. US Treasury Secretary Henry Paulson is using even more desprite terms such as: "Our economy and our markets will not recover until the bulk of this housing correction is behind us". So by opening a blank check $100's of billions of dollars will be thrown to Fannie and Freddie in the coming years to try and prop-up property market confidence. Paulson believes a blank check will bring "additional security" and "additional confidence" to the market. It probably will for now, but give it a couple of years, the US Government is so far into debt anyway, the amount of money they throw really won't matter in the long run. The $US dollar will continue to deflate towards zero and people's trust and confidence in the $US dollar, in property, in the sharemarket will erode rapidly.

The bottom line is - we too in Australia cannot ignore Fannie and Freddie and the bad stories coming out of the US today. These are all early warning signs of worse things to come in my opinion. The US will continue to bail out banks, and will continue to throw money at Fannie and Freddie.

Australia is not immune. In the last year we have seen Babcock and Brown investment bank embark on a rapid fire sale to reduce debt. Allco Finance, Centro Properties are in a similar situation. I believe many more will follow in the coming years. Sure, there might be short term stability brought back into the market, but the long-term fundermentals remain. Australia will follow the US, and we too will do what ever we can to keep the banking system in tact, and print more money to keep people happy.

Fannie and Freddie are just the beginning, there are bigger liabilities around the corner for the US and for the world. More to come...

Best,

Scott

Introduction - Welcome to my Blog

Hello and welcome to my blog.

A quick background about me:

I'm 24 and have a degree in economics.

My main interest from a very young age was to learn about money. What is money? Where does it come from? Why do some people acquire it so easily while others can never find enough of it? The phycology of money continues to fascinate me. Entrepreneurialism should be celebrated.

Furthermore, my main avenue of learning about money has taken me to the sharemarket. I have spent a considerable amount of time since mid high-school studying the Australian sharemarket, and what factors influence individual shareprices.

In summary, my blog will focus primarily on Australian and international economics, particularly monetary policy. Studying the world's current and past monetary systems can give us a insight into what will likely happen in the next 5, 10 or 20 years.

Over the next few weeks I will discus Money Supply issues namely:

Risk:

1. $US Dollar collapse

2. Inflation - smoke and mirrors?

3. Debt

4. Gold and Silver

Other areas I will try to cover off in the next few months include:

5. Superannuation - why it won't work in the long term

6. Peak Oil theory

In between I will post up candlestick charts of commodities, sharemarket indexs and particular stocks of interest.

Also, I am not a licence professional, so all material posted on my blog is merely my personal opinion. I will try to reference my sources when necessary.

Lastly, if there is one message I would like to convey on my blog it is this:

If you want to be successful in anything, you must turn your desires into reality. If you really want something, you will take the necessary steps to make it a reality. The future is what you want it to be.

Today, more than ever, it is important to take individual responsibility for your financial future. I am strongly of the opinion that the world is heading into a period of economic gloom, much worse then a recession. Those who study money and monetary history will be best able to see the risks and opportunities ahead of us.

We must do our own studies, do our own due diligence, and not accept what the Government or the media tells us at face value. We must always question what we are being told and not just accept everything we see on TV or in the newspapers. Any politician can pick the stats and numbers they want to massage an argument they want to convey. We must cut through the crap and instead utilise objective, empirical evidence.

I encourage everyone to take action today and Invest time into financial education.

Cheers,

Scott