Can't see the forest from the treesIn Australia today, we are being reassured by the Australian Government that "Australia is different", that we can "weather the financial storm in the United States". This can't be further from the truth. The economic/financial systems in Australia are essentially identical to the economic/financial systems in the US, Europe and around the world. The immediate fallout from the US, so far, is in our sharemarket, and consequently, in our retirement savings (superannuation).

There are differences in regulations between countries, but regulations cannot prevent the market from what it wants to do. If the sharemarket wants to plummet. It will plummet. Central banks and governments try to influence and manipulate markets, and they fail time and time again. They try to put a bandaid on problems such as the sub-prime crisis, without looking at the root causes. Governments are essentially powerless to the market forces. You cannot change the direction of the tide.

Is the Australian economy strong today? - Our unemployment rate is 4.1% (seasonally adjusted)

- We have 10.7 million workers and 457,000 unemployed;

- "Official" CPI inflation rate is 4.5% (year end to 30 June 2008);

- Exports are growing strong, but so are imports; and the

- Australian Dollar has been strong compared to most currencies in recent years.

These numbers still sound great, except inflation has gone well over the 2-3% RBA target band. Australia now has very low unemployment, and retail spending is still buoyant. Export values are climbing fast. Today, we feel more distant from the problems in the US. We cannot see the forest from the trees because the current good times have been going strong since the early 1990s. Look at the big picture!

We cannot ignore what is happening in the US. It will affect us in a huge way… it’s a matter of timing. Wait for when the unemployment rate will turn around and head towards 7-10% again. Inflation is already on the rise. With high inflation and more people unemployment, foreclosures in Western Sydney and Melbourne will become more frequent. The wheels will start to fall off.

Is the economic data reliable?As I have stated previously, politicians, scientists, journalists or whoever can bend facts to make their argument look better then another person's argument. One scientist can use one set of data to try to prove climate change is man made, while another scientist could use a longer data set to prove climate change is a natural, cyclical process. It's the same with inflation and unemployment data. Numbers are based on methodology and reliability.

Measuring Inflation Lets look at inflation. Is it really 4.5% in Australia today? It might be if you have full confidence in government.

Inflation in Australia is measured through a the Consumer Price Index (CPI). It measures quarterly changes in the price of a "basket of goods and services". Items consumed by the CPI population group (capital cities) include things such as: food, health, housing, household contents, alcohol, clothing, and transportation. Common items such as milk, bread, cars, petrol are collected monthly as they can be quite volatile in price.

Your spending habits may be completely different to what's in the basket. A family renting, with 3 kids under five years, spending $20 a week on milk will have different spending habits to a retired couple who has no mortgage, and is travelling around Australia (for this couple price inflation for food and fuel will vary greatly around the country). I believe CPI does not represent the true cost of inflation. Ask farmers what the price inflation of fertiliser has been in the last 12 months, or ask manufacturers who are buying steel. A lot of the inflation in the economy has been in input prices (fuel, commodity prices, wages etc.), not output prices (what end users will pay).

At its most basic level, I previously mentioned that Australia's money supply expanded by 23% in the year to end June 2008. This tells us there is a lot of inflation coming to Australia very soon. In this year alone the 23% extra money in the pool has to "find a home". It will compete with existing money to push up rent prices, food prices, property prices etc. Real inflation is much worse then the CPI is telling us.

In Australia, the CPI method was first introduced in 1960. Since this time the CPI has been reviewed and reweighed 13 times – generally every 5 years. In 1998 for instance, several major changes were made to the index. That is, CPI changed from measuring living costs of employee households to a general measure of price inflation for the household sector as whole. Changing the methodology, and changing what's in the basket and outside the basket, changes the outcome. The same happens with measuring unemployment rates. Changing the defition, changes the published unemployment rate. We cannot easily compare apples today to apples fifty years ago, because the apples today have been diluted.

CPI is just like what happens on the sharemarket. Standard's and Poor's (S&P) review and reweigh their share index's four times a year. Take the ASX top 100 stocks. If a stock has performed badly it is removed from the index and replaced by a better performing stock. For instance, Centro Properties was removed recently because its share price has fallen 91% in the last 18 months. By removing the bad companies (or items) out of the index, you can make the index look better over time then what it would be otherwise.

What we must do instead is

measure items in terms of our purchasing power. Today, a lot more households have two breadwinners to try and pay off the mortgage and to meet expanding debt liabilities. A few decades ago, most households had one breadwinner to pay the mortgage and everything else. Back then there were no computers or plasma's, but people still bought houses, cars and food. Are we really any more prosperous today? Cars and restaurants might be fancier today, but they still serve the same purpose.

Inflation in the United StatesLike Australia, the US has constantly reviewed and reweighed how it measures inflation. The following charts shows this quite clearly.

Chart 1: Real Money Supply Growth in the US

According to shadowstats.com,m3 money supply growth in the US grew by 17% in 2007. Remember from my previous post, the US stopped publishing M3 money supply in March 2006. This is the fastest rate of money supply growth the US has seen ever. This new money (including the $700bn if approved by Congress) has to find a home in prices somewhere...

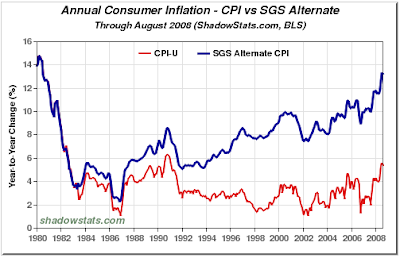

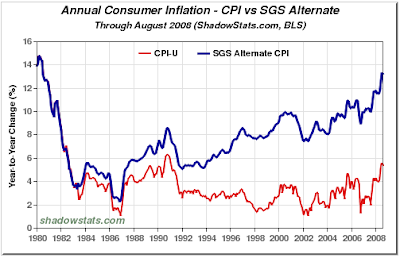

Chart 2: Real Inflation in the US

According to shadowstats.com, if the US did not keep diluting its CPI measures, real inflation in the United States today would be around 14% per annum (blue line), vs what the government tells us (red line).

Chart 3: CPI today compared to pre-Clinton administration.

So the pre-clinton CPI would be about half-way between the red and blue lines in Chart 2. Obviously Government is keen to dilute the facts more and more often (as the news gets worse).

Extreme Price MovementsThere are 2 main types of extreme price movements and economy can experience.

1)

DeflationDeflation is the opposite to inflation. It is when there is a contraction in money supply (a decrease in prices of goods and services). Money is becomes illiquid and does not flow.

2)

HyperinflationHyperinflation is extreme inflation of prices. It is when prices are increasing by 1000% or more per annum. Think of what's happening in Zimbabwe today. It's money supply is currently doubling in price every 28 days. So if your home is worth $5 million today, it will be worth $10 million in a month's time. You will not be any more wealthy, just the opposite. Purchasing power erodes rapidly during hyperinflation. Wage increases wouldn't be negotiated yearly; they would be negotiated fortnightly or weekly under hyperinflation – just to keep pass with increases in the cost of living.

Old and new wordsFor the last few decades the media has largely used terms such as inflation and recession. ie. mild hike in prices, and mild economic downturns. These words will be replaced in coming years by hyperinflation and depression. We are heading for "extreme" inflation and a "great" depression (GD2?). Governments, the media, and the people will have to change their context and get with the times...

The next Great Depression will be characterised by hyperinflationThe last Great Depression of the 1930s was a deflationary one, characterised by prices collapsing. The next Great Depression will likely be more along the lines of what is happening in Zimbabwe today, or in Weimer Germany in the early 1920s. The 1930s Great Depression was deflationary because the gold standard invoked monetary discipline, whereas today, the limitless printing of money will create hyper-inflationary pressures on prices. Both deflation and hyperinflation cripple purchasing power, employment and the normal functions of an economy.

For some great to-the-point commentary on the current economic environment in the US and where we are heading, I strongly recommend reading John Williams (of Shadowstats.com) Hyperinflation report (of April 2008).

Williams states that "what promises hyperinflation this time is the lack of monetary dicipine formerly imposed on the system by the gold standard, and a Federal Reserve dedicated to preventing a collapse of the money supply and the implosion of the still, extremely over-leveraged domestic financial system."

Williams believes

the US will experience hyperinflation as early as 2010, if not before, and likely no more than a decade down the road from today. The US can no longer turn around and avoid financial Armageddon. As I've previously stated, the US and the world can only print money to meet existing debts and future obligations. The US Dollar will eventually collapse and be worth its true value – nothing. The same result will happen to the Australian Dollar, the Euro etc. All currencies today are paper money or fiat. It is no longer backed by an asset of value, namely gold. It is backed by our confidence in government. Throughout history all fiat currencies have collapsed.

Interestingly for many, Williams also details that the next US President is highly likely to be a Democrat (Obama) based on a simple economic calculation. "In every Presidential race since 1908, in which constant, real (inflation-adjusted) annual disposable income growth was above 3.3%, the incumbent party holding the White House won every time." Below 3.3% growth, the incumbent party would lost every time. "(today) the current annual growth in real disposable incomes is at 2.2%". ie. a victory for the Democrats.

I will repeat again, regardless of whether it will be Obama or McCain, both candidates will follow the Federal Reserve and print, print, print its ways towards hyperinflation and the US Dollar will eventually collapse. Neither candidate is looking at the root causes of sub-prime, the collapse of the investment banking model, the collapse of the US Dollar.

The root cause is Government! It is Government which severed all ties to the linking currency with Gold in 1971. It is Government which created the Federal Reserve in 1913 (a market manipulator). It is Government which has encouraged business and individuals to use Keynesian economics – the system which encourages: inflation, debt and the devaluation of the currency. The world will head to a great depression and remain in a great depression until a leader is elected that recognises these facts! Ron Paul was the only Presidential Candidate this time that understoodd the flaws to the current monetary system, however he was not popular today because the masses want free money thrown at them to fix the system. Printing money will not be sustainble to meet medicare obligations, social security payments etc. You have to keep adding more wood to the fire to keep it going.

The Great Depression will end when currency is linked back to gold (real money).

The world got out of the last Great Depression in 1944 due to the creation of the Bretton Woods system, not because of World War II as most historians recite. After WWII, the world had no workable monetary system. The system had to be re-drawn because the United States had accumulated a bulk of the world’s gold and silver during the war from other countries which took loans from the US. (The US Government had about 6 billion ounces of silver – today it has none!). In a nut shell, the monetary system created at Bretton Woods (in the US) linked currency back to the gold. The US Dollar became the world currency, and would be redeemable to gold at US$35 per/ounce. The system ultimately collapsed in 1971, because France started cashing in its US Dollars for gold. Other countries started to follow, and the US lost over half its post-WWII gold reserves. Bretton Woods was far from a true gold standard; it was a quasi-gold standard and was fundamentally flawed. Gold is finite.

It all comes down to

economic accountability. The United States, Australia and the world has been using an economically irresponsible monetary system. Throughout the last century, the strings have gradually been released, moving the system from gold (economic discipline) to all-out "government backed" fiat currency. If an individual does not pay off their credit card, the bank with eventually cut it up in front of you. Central Banks around the world are on the verge of cutting up the US Dollar in front of the US Government, and consequently all world fiat currencies. The fiat system only works because of confidence in government. This confidence will collapse due to the forthcoming hyperinflation great-depression. Paper money won't be worth the paper it is printed on.

Best,

Scott