It’s asset-deflation

Deleveraging of financial assets worldwide has been driving short-term deflationary pressures on world money supply. I label this as asset-deflation or debt-deflation. Deflation has a snowballing effect. It comprises of:

a) Illiquidity. When buyers hit the sidelines on expectations that prices will fall lower in the future.

b) Spreads Widen. With buyers drying up, the difference between what the nearest buyer is willing to pay and what the seller expects to get paid widens. For example, someone may believe their house is worth $500K, but the nearest buyer is now at $400K, causing a spread of $100K. In other words, the house is only worth what the nearest buyer is willing to pay!

c) Many sellers exit the market at almost any cost. In a rising market, buyers out bid each other to acquire an asset. In a deflation environment, many sellers are forced into a position to sell to the nearest buyer (even though it may be vastly under what they believe their asset is worth). There doesn’t need to be many sellers in an illiquid market to make prices fall sharply (just like a lack of buyers). For example, if someone forecloses on their mortgage, the bank will offload the property back onto the market and get what ever it can. As unemployment rises, mortgage default rises, the quantity of surplus properties in bank hands rises. This causes more asset-deflation.

Baby Boomers

More so in the future, demographics will be a major influence on asset-deflation. The Baby Boomer generations is the largest living generation in the United States, Australia and many Western economies. As they move into retirement at the end of their working life, many will sell down their properties, businesses, and shares (held in the Superannuation accounts). However the following generations will be unable to match this selling pressure as they are starting our/half way into their working life. This factor alone will ensure the next 20 years will be vastly different to the last 20 years for financial (DEBT) driven assets.

Asset-deflation should be embraced

Prices have been lifted artificially high for too long, and now the market forces are accounting for misallocation of capital.

Governments, central banks, commercial banks and individuals fear asset-deflation. This is why the Australian Government is guaranteeing deposits, the States debt, forming a Rudd-bank (commercial property fund). The aim of the Federal Reserve (and central banks worldwide) is to ensure property has soft landing so people feel wealthy again. They now want to prevent massive asset bubbles from bursting as it will destroy the artificial wealth effect.

artificial wealth effect - the general population get angry when food prices, rent prices continually inflate (because of an expanding money supply), but also dislike when the sharemarket and property values fall in price (again, due to an expanding money supply). We can’t have it both ways.

Historically property prices are said to double every seven years. What is never mentioned is how much the money supply has grown every seven years, or how our purchasing power has decreased every seven years. For example, if you buy a property for $100K in 1988 and sell it for another house in the surrounding suburb, you would have to pay around $100k for a similar house. Come forward to 1998, that same house is now worth $200K, but if it were sold, you would still have to buy a similar house in that area for around $200K. House prices have doubled in this 10 year example, but overall purchasing power decreased as the M3 money supply more than doubled. This is an artificial wealth effect.

A couple more points. The 1970s and 1980s were ideal times to acquire and invest in property and the sharemarket. The market was in a Debt-cycle. From 1982 to 1999, commodities were largely lousy investment and lost purchasing power. The two cycles have an inverse relationship. We currently remain halfway through an average commodity cycle. The purchasing power gains will continue to occur for gold, silver and most commodities, while the purchasing power of investing in the sharemarket and property will continue to decrease.

By design the system must inflate

The monetary system is designed to inflate over time and reduce our purchasing power. The system is mathematically designed on an exponential growth curve.

These factors include: fractional reserve banking, mandatory savings scheme, government monetary/fiscal power.

i) fractional reserve banking.

Every time someone signs a new mortgage or a new bank loan, new money is created right there and then. Fractional reserve banking is at the heart of the flaws in today’s monetary system. By design, all debts can never be repaid. Exponential credit (debt) is guaranteed. Therefore many nations, businesses, individuals will remain in spirally debts and bankruptcies.

“The most powerful force in the universe is compound interest” - Albert Einstein

ii) mandatory savings scheme (Superannuation)

Superannuation, Government Funds (such as the Future Fund) artificially inflate asset prices over time as they provide excess liquidity to the market and a guaranteed source of continual investment. By design, these schemes also need asset prices to inflate in price.

iii) Government monetary and fiscal power

The reason we have such extreme volatility in the economy is that Governments central banks, commercial banks try to re-inflate bubbles whenever market forces try to account for bad debts through asset-deflation. Central banks (through monetary policy) around the world are currently lowering interest rates in a desperate attempt to manipulate investor decisions, to draw more financially able investors into the asset-deflation black hole. Central banks/Governments aren’t lowering interest rates so people buy more food or enter the rent market. The monetary framework today is all about saving the PRICE of financial assets (debt).

Through fiscal policy, Governments are giving financial incentives (free handouts - free as in using taxpayer money…), such as the first home owner grant to artificially keep house prices high. In the future (its already happening…), these insentives will be funded by Government-debt.

These actions ensure the longer-term money supply will inflate over time and that debts will become increasingly unsustainable.

iii) a) the US Government is insolvent

The US Government currently has a national debt of US$11.2 trillion. Right now the US Government is spending almost. In 2008, the interest repayments on the national debt is US$431 billion (around 14 percent of the annual budget). When you add future liabilities (of an aging 80 million US baby boomers) such as Medicare, Medicaid and social security – debt liabilities total over US$65 trillion.

The US Government cannot escape its debt situation without borrowing more debt. The Government will never consider reducing Medicare or pension liabilities. The result – more money has to be created, and purchasing power must continue to decrease.

Cause and Effect

Economics is all about cause and effect. Unfortunately many (including our current PM) do not understand both elements.

Fractional reserve banking, mandatory savings scheme and Government monetary and fiscal power are all causes. The consequence is Inflation (loss of purchasing power).

Likewise, many journalists continue to ignore the root causes of deflation, but are fixated on reporting the effects of (asset) deflation. For instance, many are now writing up articles about how wages are falling across many Western economies. Wages just don't fall on their own. Wages are falling as a consequence of something else happening. That is, businesses are collapsing due to DEBT, the drying up of liquidity in markets (including debt markets) and as a result, demand is collapsing. Consequently, as the number of unemployed rise, wages come under pressure as they should.

The CP”lie” – is money supply deflating?

Another mechanism now entrenched in today’s monetary system is the constant dilution (manipulation) of Government statistics. Unfortunately Governments and media are now fixed on the Consumer Price Index (CPI or CP-“lie”). It’s the intention of Governments (and thus the media) that it is possible to sell the idea of deflation through manipulated statistics (particularly CPI).

Currently in Australia, the official CPI rate is 2.5 per cent.

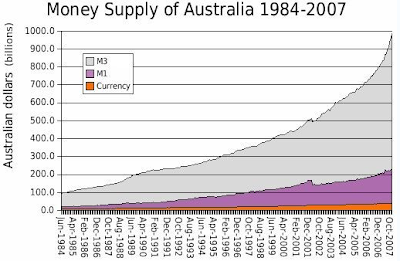

Australia’s money supply is still inflating

In the year to March 2009, Australia's money supply:

Broadmoney 12.4 per cent;

M3 increased by 15.1 per cent;

M1 increased by 8.1 per cent.

There is no deflation in the money supply numbers. It's all on the RBA website. It's the media's fixation on CPI that a drastically diluted scenario is continued to be created. We will never hear what real inflation is doing through the mainstream media.

Chart 1: Exponential curves keep expanding

source: Wikipedia

source: WikipediaChart 2: A chart from my second post last year.

The above chart shows the annual grow rates of Australia's M3 money supply. It's not a conincidence that both the sharemarket and property market continued to bubble in the last couple of years (as M3 grew at a faster rate). Expect M3 volatility like the 1970s over the next couple of years (at least).

The above chart shows the annual grow rates of Australia's M3 money supply. It's not a conincidence that both the sharemarket and property market continued to bubble in the last couple of years (as M3 grew at a faster rate). Expect M3 volatility like the 1970s over the next couple of years (at least).Japan’s decade of deflation?

Money supply has consistently increased in Japan during the last couple of decades whilst it has experienced deflationary pressures. Asset prices (property, sharemarket remain well below the bubble levels of the 1980s). As the following chart shows, the inflator mechanisms of fractional reserve banking, monetary and fiscal policy etc have meant that Japan's money supply has continued to grow even those asset prices are still subdued.

Chart 3: But the money supply is still growing?

source: Wikipedia

source: WikipediaJapan has already been through much of what the Western World is now facing: significant asset-deflation. (Obviously there were other issues going on such as the zombie banks, several stimulus measures etc which I will go into more depth another time).

Summary:

Assets worldwide are being deleveraged and revalued by the market. Asset-delfation is healthy and should be embraced by Governments, banks and individuals worldwide. The market is accounting for excess money and debt in the system.

In Australia the current CPI is 2.5 per cent p.a., banks are offering around 4 per cent interest for savings. Official M3 data shows overall money supply inflation is 15 per cent p.a.

- Aren’t our savings going dramatically backwards in the bank?

- The RBA shouldn’t be reducing interest rates!

Ultimately when it comes down to the inflation/deflation debate, ask yourself this:

* Will the Australian Dollar (or other fiat currency) increase or decrease its purchasing power in the next couple of years? (in this "deflationary" environment). How much stuff will it buy in the future compared to today. This is the crux of the issue.

Remember there is a huge difference between price and value.

- Scott

1 comment:

It's always irritating to come across a subject where sides are hard to take.

Post a Comment