The Chinese Miracle?

The growth of China's economy in the last 15 years is nothing short of a "miracle". Compared to the other miracle economies, the 4 Asian tiger economies up to the 1990s and more recently the Celtic Tiger (Ireland - the roaring tiger of Europe - look where it is today!), China is in a completely new ball park. No country in history has built so much stuff in such a short space of time. World production of materials is mind-boggling. China can do it all, and in turn is de-industrialising higher-cost manufacturing in the western world. Demand for iron ore, coal, copper right down to steel and concrete has exploded. But can China perpetually build more and more steel mills and skyscrapers?

Well, no...

China is vulnerable to economic depression. The common denominator in every country is that all the banks operate under insolvent conditions, its just that the citizens rarely force a bank run to prove this Achilles’ heel. The main point here is, the common base line in every country today is the type of “money” used. The US Dollar, Australian Dollar, Chinese Renminbi and the Zimbabwe Dollar are all fiat currencies. Whilst there are significant differences in value of these currencies (or rather the rate of devaluation/loss of purchasing power), all currencies around today are still “fiat”, that is, money which is declared by Government to be legal tender and without intrinsic value (no gold backing). Through fractional reserve banking ("Money creation") and printing new money into existence the rate of economic growth in any country can be very rapid for a number of years. However, all good parties end in one big hangover. China's hangover is coming (particularly if they do not prepare for post US-Dollar monetary system).

Now that we have apparently coming through the worst of the so called Global Financial Crisis (GFC), every second economist on the street has hailed China as the world’s savour, and indeed in Australia, the Deputy Governor of the Reserve Bank of Australia RBA), Ric Battellino, believes the commodities boom could last for another 15 years – all of course, thanks to emerging economies of China and India.

Whilst I agree that China has helped the world during the GFC, and that we will continue to be in a long-term commodity boom, my reasons are completely different. And here is why:

• Chinese Banks inflated the world out of the 2007-2009 Global Financial Crisis

• The Commodity Boom over the next 10 years will be extremely volatile

Chinese Banks on steroids…

Answers to the future often lie in history. China invented paper money way back in the 10th Century AD. Every single paper-fiat currency created since (except for those existing today) have collapsed to a net worth of zero. Fiat currencies will always come and go because Government's cannot resist the temptation to use inflation to pay for election promises (or to help keep opposition parties out of government..). China, and every other country will not be able to defy economic reality with fiat currency this time around either. Keynesian economics will hopefully follow soon after.

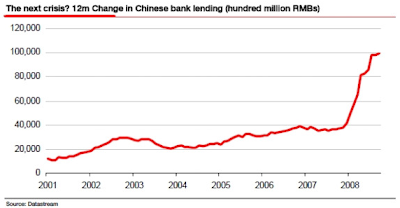

As the following two graphs demonstrate, it’s the major global bank’s that fuelled the sub-prime bubble (in the US) which led to the GFC, and then subsequently it was Chinese stimulus spending and bank lending which helped the world get through the worst of the GFC. China just filled the void to get the world through the first phase of economic depression. This banking bubble is completely unprecedented. There is still many decades of debt still in the system - which is yet to be paid (accounted) for.

Chart 1: Global banking bubble

source: ABC News

source: ABC NewsChart 2: Chinese banking bubble... but who will save the Chinese banks!?

The RMB¥ 4 trillion (US$ 586 billion) Chinese economic stimulus plan announced by the Chinese central government was all aimed at getting Chinese companies to build more Chinese goods and buildings. As I will explain a little bit on, China was already building at a very fast and unsustainable rate. This stimulus inevitably brought forward work and is now creating double digit inflation to their economy. Increasing credit always delays and make bubbles worse.

As consumer confidence was low in the US, and China, Japan and Asia were unable to keep exporting products to the US consumer, China took up the slack and increased bank lending dramatically, converting their economy from being strongly export-oriented (to the US) to fuelling domestic demand through stimulus. The Chinese Economic Stimulus Plan was used to offset the sub-prime housing crisis in the US to counter-act it with a Chinese property bubble. In essence, creating a new bubble market to replace a busting bubble market. The end result, I strongly believe, will have dire consequences to China, and Australia and the rest of the world. Like holding out a red flag to a charging bull, China will soon get caught out.

For now the commodity boom will continue, but… the next 10 years will be characterised by extreme volatile periods of double digit annual growth to significant periods of price deflation. Ultimately, gold, silver and soft commodities (food) will be sought after on-mass. People will change their spending habits to have economic security.

Construction, construction, construction!

Construction now makes up 60% of China's GDP. This compares to single digit GDP for China's total exports. China is building and manufacturing absolutely everything for the world, ten times over (or more?)

James Chanos:

No country has ever had done more than 9 years above 33% of GDP (in fixed assets – construction). China is now on its 12th or 13th year.

You gotta be in property! (especially if you are a central government)

In August this year the Financial Review ran an interesting article (lost on page 60) on China's central government trying to cool its property bubble. The article reported that all sorts of random companies were delving into property, from salt companies to railway companies. It goes on...

All around the nation, giant state-owned oil, chemical, military, telecom and high groups are bidding up prices on sprawling plots of land for big real estate projects unrelated to their core business. ...

By driving up property prices, the state-owned companies are working at cross-purposes to the central government's efforts to keep China's real estate boom from becoming a debt-driven speculative bubble.

Records show 82 per cent of land auctions in Beijing this year were won by big state-owned companies outbidding private developers - from 59 per cent in 2008.

Further:

land prices in Beijing had lept 750 per cent since 2003, and that half of tha gain had come in the past two years. Housing prices have also sky-rocketed, doubling in many cities over the past few years.

And as the prices of new apartments soar - in Shanghai, for instance, they often exceed $US 200,000, while the average disposable income isa bout $US 4,000 a year.

The article also made reference to the status of the state-owned banks. They they:

- had made $US 1.4 trillion in loans, nearly twice as much as the year before

- were making off-balance sheet manoeuvres

- were likely sitting on enormous unreported debt

Lastly, the article argues that different levels of government were behind the push in real estate because it was so "incredibly lucrative". Many municipalities have formed local investment vehicles that borrow from state-owned banks to pay to relocate citizens to build on their land, so the government can then auction off the new properties for profit.

Does this all sound like Sub Prime Mortgages on steroids times by a factor of 10?

Housing Affordability in China

One clear clue (regarding the rising real estate prices in China) is that the average price-to-income ratio in Beijing has reached 27:1, five times the world average, according to data from the Bureau of Statistics of the Beijing Municipality. In addition, the average price-to-rent ratio neared 500:1 in the city, far above the international alarm threshold of 300:1, which sends out a clear signal that the foundation of the real estate boom is losing stability.

Steel production up 6 fold in 10 years

To further put this into perspective, all this construction material had to come from somewhere. Of course, in Australia we know about the China boom and our record iron ore and coking coal sales have led to our highest terms of trade since the early 1950s.

Australia has helped fuel the great Chinese construction bubble. In 1999, the Chinese steel industry produced some 124 million tonnes of crude steel. This was a similar size to Japan and the United States. For comparison, in the same year Australia produced about 8 million tonnes. The following two charts illustrate the magnitude of China's construction mania.

Chart 3: China produced 16% of total world steel in 1999

source: World Steel Assoc. (public data)

source: World Steel Assoc. (public data)Chart 4: 10 years later China now produces more than 46% of total world steel output

source: World Steel Assoc. (public data)

source: World Steel Assoc. (public data)China’s steel production has gone up almost 6 fold in the last decade. To put this in perspective Australia’s steel production is now about 1% of China’s (or 0.5% of world) total annual steel production. ie. China produces Australia’s total annual steel production in just 5 days! China is now making more steel than what the entire world produced in around 1990.

To analyse this from another perspective, there are more stories in the media in recent years of ghost cities and empty mega malls springing up in parts of China.

Video: Fuelling the next housing crisis – this time in China

China also has the world’s largest shopping mall, the New South China Mall (based on leasable area) remains 99% vacant since opening in 2005. (video now unavailable)

Centrally planned economies do not work

Centrally planned economies have never worked over the longer term. I am not debating the nitty gritty of what the difference between communism vs. capitalism is, at the end of the day, the more intervention by Government’s and, particularly, central banks, the more mis-allocation of labour and capital there will be. The end result is massive overcapacity and ultimately price suppression (monopolistic behaviour on other countries). China is an extreme case at point, where the central government right down to municipal governments have had competing interests to increase employment at all costs. The municipal/provincial governments have also been competing for trophy industries, they all want to be the biggest and best at manufacturing, particularly steel and automobile industries. Exponential growth in credit, employment, and government intervention in markets eventually comes to an abrupt halt.

Far from what many economic commentators in Australia preach day in day out, that China is Australia’s economic savour amongst the global uncertainty in Europe and the US. To the contrary, I believe our over-reliance on China will ultimately bring harsh repercussions for Australia. On one side, China and the US will kill off the commodity boom. The biggest mining boom in history, inevitably will end in the biggest mining bust. The expansion plans of BHP Billiton, Rio Tinto, Fortescue Metals (among others) will result in major overcapacity, and empty ports. A huge call, perhaps crazy in today's climate, but this endless expansion will not keep going. Many of the major projects will be mothballed. Marginal projects will once again be marginal and left on ice for easy money to come around again.

James Chanos sums up the current situation rather nicely. James is best known for seeing the problems of Enron and shorting its stock up until its collapse. He recently warned that China's hyper-stimulated economy is headed for a crash, led by its housing bubble.

Its become very apparent... that China has embraced capitalism to keep the socialist elites entrenched, while more lately in the West we have embraced socialism to keep the capitalist elites entrenched. It’s a little bit of the opposite side of the same coin.

** Note ** I am soon to launch a new website at www.scottreeve.com, which will incorporate this blog and other areas of interest ~ Cheers, Scott