What is Money Supply?

- is the total amount of money available in an economy at a particular point in time.

(http://en.wikipedia.org/wiki/Money_supply#cite_note-18)

Money supply used to be backed by a gold standard. However all this changed in 1971 when the Bretton Woods system fell apart. Today money represents debt. The total supply of money is infinite so long as there is debt in the economy. No debt = no money being created.

Money supply and Inflation

To leverage our potential buying power we borrow money (debt) to be able to buy more goods then what we could have done otherwise. However, the first rule in economics is that we have unlimited wants, yet limited resources. So at its most basic level, the more money supply in existence (created from loans), the more money there is competing for food, land, labour etc. This leads to price inflation and increased volatility and uncertainty in the economy. Booms and busts become more extreme.

How do you measure Money Supply?

In Australia the RBA define Money supply as:

M0: currency

M1: currency + bank current deposits of the private non-bank sector

M3: M1 + all other bank deposits of the private non-bank sector

Broadmoney: M3 + borrowings from the private sector by NBFIs, less the latter's holdings of currency and bank deposits

M3 is generally used by economists to estimate the total amount of money available in the economy.

What increases money supply?

Every time someone borrows money from the bank, the money supply expands. If you get a new mortgage for your house, or a margin loan to buy shares, you are helping increase the money supply and you are leveraging credit. Through fractional reserve banking, banks have the ability to make money out of thin air. If the fractional reserve is 9 to 1, you deposit $1,111.12 dollars into a bank, the end result is that the original $1,111.12 can ultimately create almost $100,000 of new money!

Movie: See Money as Debt to understand how our Monetary System works today (part 1 of 5 below)

Governments can increase money supply by spending more than they tax (one of the big reasons for money supply growth in the US). US money supply has expanded significantly in recent years due to a double whammy of tax cuts and increased expenditure.

Central banks try to manipulate money supply through interest rates. Central banks do this by buying and selling government securities (and other financial instruments). Ultimately, central banks can only do so much to influence money supply. As we saw in the US earlier this year when the Federal Reserve cut interest rates quickly and threw a $168 billion stimulus package, there was short-term elation, but has ultimately did little to prevent the stockmarket and property prices from falling much lower.

Only a very small portion of money supply (M0) is in the form of currency (notes and coins) generated by a central bank to meet physical withdrawals. This is usually less than 5% of the money supply.

What decreases money supply?

When someone pays back their mortgage (or other debts), money supply decreases. Money supply also decreases when someone defaults on their mortgage or closes a margin loan account, or the Government reduces expenditure and runs surplus budgets.

Central banks try to decrease the rate of money supply growth by increasing interest rates and providing disincentives for people to take out mortgages, margin loans etc.

Ultimately today's monetary system needs money supply (and consequently debt) to keep increasing for the economy to function.

Australia's Money Supply

Putting some numbers on money supply growth and using Australia as a case study, we can see that historical through-the-year growth in M3 has been very strong.

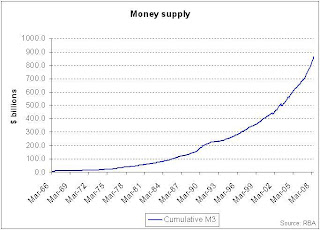

Cumulative:

- In the year from July-2007 to endJune 2008 M3 increased 23%

- In the last 5 years (to end of 2007) M3 increased 82%

- In the last 10 years (to end of 2007) M3 increased 174%

- In the last 20 years (to end of 2007) M3 increased 563%

- In the last 30 years (to end of 2007) M3 increased 1847%

As at June 2008, M3 totalled over A$1 trillion Australian Dollars.

Chart 1: Australia's historical through-the-year growth in M3.

Betweem 1971 and 1990, Money Supply growth was very volitile and tended to grow over 10% per annum. The 1990s till 2006 growth was between 5 and 10% per annum. It now appears we are heading for volitile times again.A spike in money supply will trickle into increased inflation.

Chart 2: Cumulative growth in M3 (A$ billions). An exponential curve. As MS increases, debts owed increases.

Chart 3: Log scale of Australia's M3 money growth.

Note the elasticity has been quite constant over time.

The US Money Supply

Since 1944 the US Dollar has been the world currency and until 1971 the $US dollar (and consequently currencies around the world) was linked to gold. Removing the link to gold essentially gave central banks around the world a blank check to print as much money as they want, as the amount of gold under vault no longer constrained how much money supply could exist in the economy. Money is now backed by our confidence in Government (whom guarantee coins and notes are legal tender). The paper used in a $50 dollar note is no more valuable then the paper used in a $100 dollar note – the only difference is that the Government assures us that one is more valuable than the other.

Is US Govt trying to hide something?

In March 2006 (see chart 4), the US Government ceased publishing its M3 money supply data. The reason? To save money!?

Chart 4: United States money supply

M3 was well over US$10 trillion dollars in early 2007.

The simple fact is there is so many $US dollars out there today! (remember a very small amount is actually printed notes and coins ie. M0). As the $US Dollar is the world currency, today about 50% of the world's currencies is in $US Dollars, and about 50% of the $US Dollars reside outside the US! So non-Americans have also contributed significantly to the growth of US money supply.

The US Govt is trying to hide the true rate of inflation. As money supply increases, the new money has to find a home. More money becomes available to compete for finite resources such as food and property. This is why there is always bubbles in property markets, the sharemarket etc. as more money is created through larger mortgages, larger margin loan portfolios etc. All this leads to inflation and ultimately hyperinflation. At the top of booms there is often deflation. This is when buyers hold off from buying in the expectation that prices will be cheaper in the future. Those struggling with their finances are are pushed to sell (to clear debts) are forced to sell to the nearest buyer. People may think their home is currently worth A$1 million dollars today, based on recent prices. However it is only worth $1 million if you have a buyer willing to sign on the dotted line. Your $1 million house might be only worth $800,000 if that’s where the first buyer is. This is deflation.

The $US Dollar = smoke and mirrors

We are constantly reminded by the daily news reports that over the last several years the $US dollar continues to depreciate against other world currencies (namely the Euro). However, in the last few weeks all we have heard is about the rising $US Dollar. I'm expecting this move to be a short-term pull-back, with the long-term downward trend to continue on its way.

As the $US Dollar is the world currency, it has been used as a base reference to provide a measure of value. For example, we hear the price of oil in $US per barrel or copper in $US per pound. Exchange rates are always first compared to the $US Dollar before other currencies. This continues to disguise the true value of assets. The world knows the $US Dollar is becoming more and more worthless over time. Many OPEC member countries are pushing for the $US Dollar to be dropped as the reference currency in favour of the Euro or a basket of currencies. OPEC knows the $US dollar is disguising the true value of their oil!

Is it a coincidence most basic food prices such as rice, wheat and corn have spiked dramatically in the last year? Rice has trebled in the last 12 months, yet the number of people eating rice hasn't gone up dramatically compared to say 24 months ago.

Ponder this. As more people in developing countries go from the poor class to the middle class, deposable incomes increase, and consequently the money supply. There is now more money (supply) chasing a finite resource. Add on top of this, there are hedge funds and large institutions in the futures (derivatives) markets, which help push prices higher (fuelling expectations). This all causes a bubbling of price inflation. As people soon realise they are spending more of their income on food, fuel, rent etc, wage demands increase, which economists argue is the main cause of inflation.

It's all about price expectations! If people expect higher prices, they will factor this into their spending habits. People gradually expect that fuel will cost more. Rice will cost more. Steel will cost more etc. If people expect higher inflation, they will ultimately receive higher inflation (and more money supply).

The US dollar has lost about 97% of its original purchasing power (of 1913) to inflation! The Australian Dollar has lost about the same amount of value, as have most other fiat currencies.

The Euro

A quick word on the Euro.

Chart 5: The Euro M3 money supply is fast approaching the size of US dollrs and is now about 9 trillion Euros.

Conclusions and predictions for the long-term:

- Money Supply growth tells us about the future. The faster it grows, the greater price inflation will be - "the new money has to find a home" - in food prices, in rent prices, in commodity prices etc. There is a time lag for this new money to go through the system and find a home.

Australia:

- Australia's money supply is going to expand rapidly between 10 to 25% plus, and should be volatile like in the 1970s due to uncertainties and expectations in the economy.

The World:

- The $US Dollar will continue to depreciate against most world currencies, however compare any world (fiat) currency to gold/silver/oil and they are all falling.

- The true rate of inflation in the $US is much worse then the US Government is publishing.

- Measuring goods in $US Dollars is disguising the losses in purchasing power.

- The Euro is fast becoming the new world currency; however the Euro’s money supply is increasing at an alarming rate.

In the near future I intend to cover off on some key value indicators. Namely: gold/silver ratio, gold/oil ratio, gold/Dow ratio and go into more detail on purchasing power.

Until then,

Scott

No comments:

Post a Comment