Is the economic events of today so different to that of the past? We are constantly told we are living through the worst economic downturn since the Great Depression; then we are told Australia has a resilient economy and that we are weathering the storm. Surely it can't happen to us?

"But we live in a modern, innovative, high-tech society today!"

In the 1920s America - the "Roaring Twenties", the sharemarket was booming, the humble car was built for the masses (T-Model Fords), and the population was extremely opportunistic. The population had never felt so wealthy, the horse and buggy were essentially gone from urban areas and the economy had never been more innovative. It seemed the good times would always last.

And today? We live in the so-called "new economy". A modern, innovative, high tech economy. We have never felt wealthier. We expect the good times to always get better. The next 20 years will be better then the last 20 years.

These are two different points in history - but the same human traits of economic complacency are well and truly alive today. There is usually a large economic depression every 75 years - the average life span of a human. Is it a coincidence economic lessons repeat? Is it a coincidence that each generation since the 'silent' generation (of the 1920s and 30s) has progressively had worse money habits than their parents generation? Everything used to be bought within our means, today its on credit, and we have little incentive to save for a raining day.

Houdini economy

** The big difference between 1929 and today, I believe, is the acceptance of mis-information by the general public and an acceptance to think the monetary system will always work. We live in the so called "Information Age", yet our diluted statistics mean we live in a Houdini economy. It's all smoke and mirrors. Government's have an interest to keeping the public unaware about what is really happening in the economy - to maintain political and social stability (in the short run).

However, comparing today to the past has become distorted because economists, Governments, and the media think they are comparing apples to apples. Today, statistics are treated as gospel. We believe that the stats on the nightly news are accurate, objective and unbiased. Why are we not learning from recent events? Many of the economists and bankers who got it wrong, are still in positions of power and influence. Central banks are being given expanded powers (particularly the Fed Reserve), rather than face increased accountability.

More often than not, an economic number today will be grossly diluted to that of 75 years ago. For example, the unemployment rate, or level of inflation are grossly misunderstated today.

For instance why is unemployment so low at the moment? In the 1930s it got to 32 per cent in Australia! Yet it is still around 5 per cent today, despite a recession and economic turmoil worldwide.

Answer: The ABS counts people as been employed if they are working just 1 hour per week.

But as the following chart shows, the number of hours worked has been falling gradually in the last 15 years. For starters there are a lot more part time jobs. It's good for people who want to work less, but its bad for recording what the real unemployment rate should be.

Chart 1:

Source: Kohler, ABC News

Source: Kohler, ABC NewsGetting back on topic - lets compare further to the last Great Depression:

1929 to 1932- the greatest sharemarket crash in history put the world into a Great Depression. In 3 years the market fell 89 per cent.

Current sharemarket crash? Depends on your measuring stick, namely, the monetary system has changed. 1929 money was backed by gold. Today it is backed by an exponential curve of debt.

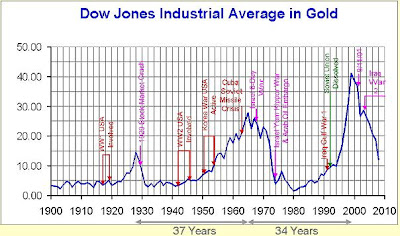

If we use the Dow/Gold Ratio (which is what the 1929 sharemarket crash was recorded against), then the current bear market we have today really started in 1999 (not 2007). So far from top to bottom of the bear market the Dow Jones has fallen 84 percent measured against gold (the old monetary unit).

Perhaps we are already in economic depression but we just aren't awake to it?

As the following chart shows, the inflated US Dollars of today have diluted the impact of what is really happening. From 1999 to 2007 the Dow Jones rose in nominal terms, while the old monetary system was showing the economy was sick (and crashing), now both these measuring sticks are showing the US and world economy is continuing to tank.

Chart 2: Dow Jones over last 100 years

Wow - look at the 1929 crash! It's huge. What this chart fails to show is that important change of the monetary rule book in 1971 (when the gold link was removed).

Wow - look at the 1929 crash! It's huge. What this chart fails to show is that important change of the monetary rule book in 1971 (when the gold link was removed).The following chart puts the 1929 crash, and today's sharemarket crash into a better perspective (apples vs apples).

Chart 3: 100 yeas Dow/Gold Ratio.

Source: Steve Hickel, gold-eagle.com

Source: Steve Hickel, gold-eagle.comThe last dip in Dow/Gold Ratio:

Notice has taken at least 32 years to reach a new peak in the Dow/Gold Ratio in the last two downturns. In the last downturn there was stagflation in the 1970s, a change of the monetary rulebook in 1971, a commodity price peak in 1982, and an increase in social security outlays of Governments among other things. There was no great depression, but inflation was accepted and new bubbles came along to occupy everyone's money. The key last time is that there remained confidence in the new fiat monetary system. I believe this time round will be different.

Clearly there is a huge difference between Chart 2 and Chart 3. Chart 2 is an inflation drive chart. Chart 2 characters a true free market which goes from undervalued to overvalued and back over time. (Change the monetary system (methodology), and you will change the shapes of the charts!)

Steel industry today vs 1920s

Lets compare 1920s and today even further...

In the 1920s, there was a huge boom in the United States steel industry. 15 per cent of steel was used in automotive manufacturing. By 1928 there was over 21 million cars, enough for 1 in every 6 Americans. When the Great Depression hit however, by the mid 1930s over 50 per cent of the United States steel capacity stood idle.

Today there is vast amounts of steel capacity standing idle also. Lets compare.

Kingdom of Rust

According to latest research from Macquarie Bank, there is some 362 million tonnes per annum of unutilised steel capacity in the world.

Chart 3: Today, around 25 per cent of the world's steel capacity is sitting idle.

Source: Macarthur Coal Presentation - 17 June 2009

Source: Macarthur Coal Presentation - 17 June 2009To put this into perspective, this is equivalent to:

- every single steel mill in Europe, Japan and Korea shutting down OR/

- ¾ of China’s steel production closing down.

With all this recent iron ore hype in the Australian sharemarket (in the last couple of months), just stop for one moment and envisage 3 out of every 4 steel mills in China closing down. Only the lowest cost (lowest debt) iron ore, coking coal, steel producers could survive a sustained turn down. Clearly there is too much capacity worldwide. This is not unique to just the steel/iron ore industries. The capacity for most goods today is built on the premise that the current monetary system will continue to work, that the world economy will continue to expand at a rapid rate, and that our tolerance of debt will continue to expand.

All this extra capacity will have to be removed from the system. Many companies will continue to go under. This is only natural. In the boom times too much competition led to cheaper cars and airfares, and even steel was pre-fabricated in China and exported back to Australia! There needs to be a giant shake-out across industry worldwide. Give it a few years..

Baltic Dry Index

Much of the gains on the Australian Securities Exchange (ASX) in recent months have been on the back of a bounce in commodity prices (ie. A fall in the US Dollar), and increased shipping movements out of China for Australian iron ore and coal. This has also lifted the Baltic Dry Index (BDI), which had a major crash in 2008. The BDI is a daily number published by the Baltic Exchange – it tracks world wide international shipping prices for dry bulk cargoes such as iron ore. It shot up in the boom years, and crashed big time last year as the following chart demonstrates.

Chart 4: Baltic Dry Index crashed 94 percent when the resources boom bust, its now rebounded on growing Chinese iron stockpiles.

Source: Bloomberg

Source: BloombergThe following chart from Alan Kohler pictures an interesting relationship between the BDI and movements in the Australian and US Dollar. Positive movements in commodity prices (particular in US terms) and the BDI - is a positive force for the Australian sharemarket.

Chart 5: Baltic vs AUD

Source: Kohler, ABC News

Source: Kohler, ABC NewsI believe its now time for the BDI to fall sharply once again. The third quarter of the calendar year is traditionally the worse for commodity prices (from my experience, particularly in base metals). Apparently about 10 per cent of the world Capesize ships (the largest) are sitting of Chinese ports, unable to unload their iron ore. The two largest iron ore terminals in China are said to be close to full capacity. Now that the 2009/10 iron ore benchmark prices have been finalised (with Japan and Korea), my bet is the Chinese have done most of their shopping for this year, and will try to manipulate the market in the short-run to really hammer down prices come next year.

World Trade

Ok, so i've talked about the BDI - what about world trade as a whole?

The following chart from Alan Kohler paints a bleak picture for world trade. It uses a base of 100 for the peak in world trade (some 12 months ago). Already we have gone from a massive boom, and the big bust continues at a greater magnitude than the 1929 trade bust. Just like the 1920s America – there is significant overcapacity in the world. Trade flows are stalling.

Chart 6: World trade has fallen off a cliff much higher then the Great Depression slump.

Source: Kohler, ABC News

Source: Kohler, ABC NewsCovering up debt - back to the suitcase method

We all know what hiding bad debts can do... Subprime mortgage-backed securities, bundled together, given a AAA rating and sold overseas to unknowing investors worldwide. This grand scheme worked for a while... now it appears the humble suitcase is back in vogue to move Government debt around.

Here is a rather amusing article. If this were true... the US/Japanese Governments are running out of places to hide their debt!!

Suitcase With $134 Billion Puts Dollar on Edge

Two Japanese men are detained in Italy after allegedly attempting to take $134 billion worth of U.S. bonds over the border into Switzerland. ..Bad news can only be covered up for so long. Question everything!

The trillions of dollars of debt the U.S. will issue in the next couple of years needs buyers. Attracting them will require making sure that existing ones aren’t losing faith in the U.S.’s ability to control the dollar. ..

Think about it: These two guys were carrying the gross domestic product of New Zealand or enough for three Beijing Olympics. If economies were for sale, the men could buy Slovakia and Croatia and have plenty left over for Mongolia or Cambodia. ..

Let’s assume for a moment that these U.S. bonds are real. That would make a mockery of Japanese Finance Minister Kaoru Yosano’s “absolutely unshakable” confidence in the credibility of the U.S. dollar. ..

Scott

No comments:

Post a Comment